How Much Money do I need?

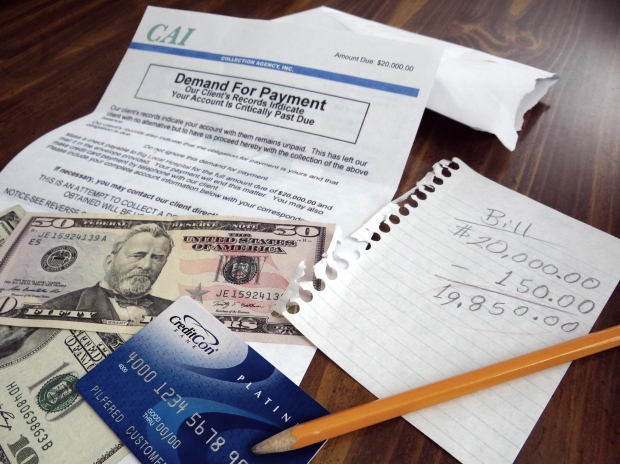

“Lawyer’s fees” are often a confused area of a real estate transaction. In the midst of budgeting for most people’s largest financial transaction of their lives, individuals are looking for some cost certainty on what it is going to cost them to close their house purchase. While it is simple enough to give a quote for fees for our clients, it doesn’t give them the full picture of what the transaction is going to cost over and above the purchase price of the property.

There are a lot of moving parts when completing a house purchase, and until we get all the information, we cannot prepare all of the adjustments necessary to provide you a detailed cost. However, this article attempts to give you insight into those moving parts of a real estate transaction. This is intended to be a checklist of costs that you should consider as you move towards homeownership. Please understand that many of these costs may not apply.

(1) Lawyer’s fees

My firm gets paid for the service that I provide to you. These “legal fees” are the primary cost centre by which I get compensated for this transaction. The remainder of these costs are those which my firm incurs on your behalf or prepaid costs paid by the vendor which you are reimbursing. The legal fees are the one area that can vary significantly between lawyers.

Lawyers use a number of different ways to cost out real estate transactions. Some look at the value of the property, while others have a set fee. Purchases with mortgages will usually cost more than purchases without. Some will have additional fees for additional services like preparing an offer to purchase, or reviewing estoppel documents in a condominium purchase. Make sure you let your lawyer know exactly what you need (or ask if there are other fees that may occur) if you want a more accurate quote.

(2) Disbursements

Disbursements are the costs paid by a law firm for the client’s benefit. We add these costs to your invoice in order to be repaid for the expenses we have incurred. These include:

Title and other Legal Searches – We want to make sure that you are getting the property that you intend, and that there are no unexpected surprises on the title. We search the title at various stages of the transaction to ensure it is proceeding as planned, and we are charged for each search that we do.

Transfer and Registration Charges – Traditionally, purchasers are responsible for paying the cost of transferring title into their name. Land titles charges a fee based on the value of the title, which amounts to $300.00 for every $100,000.00 of value, with some special exceptions. There are also fees for the registration of the mortgage against the titles that it is secured against.

Tax Certificates – In order to ensure that taxes are up to date, we order a tax certificate on your behalf. They are normally charged at $30.00 a property but each municipality can be different.

Title Insurance – This is an insurance product that is purchase on you and/or your lender’s behalf to deal with a number of title related defects or frauds. Sometimes it may be required by your lender, and other times it is a personal choice to have additional insurance by the purchaser. The cost is quoted on a per transaction basis, and increases with the value of the land.

Miscellaneous – There are number of office disbursements that a law firm may charge to you. This could include photocopying, faxing, courier charges, postage, and any other cost centre necessary to close the transaction for you. An estimate of these charges should be available for an ordinary real estate transaction.

(3) Adjustments

Your lawyer’s office will adjust the purchase price to reflect some prepaid expenses that have been incurred by the vendor, or some amounts not yet paid by the vendor that they should be considered responsible for. These include:

Property Taxes – City taxes for a calendar year can be due at different times, depending on the municipality. In Regina, the taxes are due at the end of June for the whole calendar year. Depending on if the vendor was on TIPPS (a monthly installment plan set up by the City of Regina) or if it is after the tax due date, the vendor may have paid more than their share of property taxes for the year. On a prorated basis, we look at how much they should have paid as against how much they did pay, and add the excess (or subtract the deficit) from the purchase price.

Condo Fees – Condo fees are due monthly in most cases. We will prorate the condo fees that have been paid in advance, and add them to the purchase price. We will get this information from the estoppel certificate, which your Realtor will obtain from the Vendor.

Be careful with any arrears or special assessments that show up on the estoppel certificate. If there is any chance of confusion about who is responsible for their payment, make sure that it is clarified in the offer.

Water Heater – Regina has a number of water heater companies that rent out units to homeowners. The rental is paid in advance, and often the rental will remain with the existing property. We will prorate the rental based on the days remaining on the contract.

Debts to be Paid Out – Lenders on occasion need certain debts to be paid out to reduce the debt servicing ratio of their clients. We will need statements of those accounts, and the funds necessary to close those accounts.

(4) Mortgage Costs

Appraisal fee – A lender will require some form of appraisal in order to assess if the property is worth the purchase price. They have a number of methods to do this, including sending out an appraiser to the property and providing a report. The lender may transfer this fee to the purchaser.

Tax Holdback – If a lender is paying your property taxes on your behalf, they may hold a portion of your mortgage funds in a tax account. This is usually when the purchase is close to the tax payment due date. As there are no funds in the tax account, the lender holds some back so that the account is not significantly in arrears.

CMHC/Genworth Fee – If you are purchasing a home under a high ratio mortgage, there will be a fee that is payable to one of the mortgage insurers. The amount will be added to your mortgage, and taken from the funds prior to them being disbursed to the lawyer.

Title Insurance fee – A lender may require title insurance, similar to as described above. It may require that it is paid from the proceeds of the mortgage directly.

Broker fee – In exceptional circumstances, individuals with poor credit may run into broker’s fees. It is an amount charged to compensate brokers when dealing with lenders who deal with riskier clientele.

Interest adjustment – Depending on when a mortgage is funded and when the regular payments commence, some lenders will holdback a small amount. This amount is used to pay the interest from the dispersal of funds to the lawyer to the interest adjustment date. The alternative is that the lender seeks a smaller payment from the borrower to make up the interest that was incurred until the regular payment schedule commences.

(5) Transactional Amendments

On occasion, agreements will provide for a credit or adjustment that will occur after the closing happens. For a purchaser, the credit will decrease the amount of money necessary to close the deal. For example, a buyer may have a problem with the furnace, and ask for a credit of $5,000.00 on the transaction on closing. Upon closing, the Buyer will pay the full purchase price, but receive $5,000.00 in return.

Lenders will always want to know about this type of adjustment, and it could reduce the amount that they are able to lend to you. We are often required to report pricing adjustments to lender, even if they happen “at closing”. You want to make sure that the lender does not require you to come up with that difference, or that you will be out the money you needed for an important renovation project.

(6) Interest upon Closing

There are a number of reasons that funds to close deals are not exchanged on time. It could be the delay of your lawyer, the other lawyer, you, the vendor, your insurance, your title insurance, your mortgage company, your Realtor, land titles, etc. In order to minimize hassle for a new purchaser coming into the property, an industry convention has emerged that allows for the purchaser to take possession of the property but to pay interest at the rate as agreed between the parties. Under the standard Realtors form, this amount is the Bank of Canada Overnight Rate Target plus 4%. At the time of this article, this resulted in interest at a rate of about 5%. Builders or private deals could use different rates, both higher and lower.

The reason that this convention has emerged is fairly simple: If you are using the house, you should be paying for it. The interest is covering a fair amount of interest that would be accruing to the vendor for not being able to pay off its mortgage in time.

The calculation of this amount will not become clear until your receive the documents from the vendor’s lawyer. Some lawyers will not accept your down payment until all funds are available, and some will. The amount that you are paying interest on, and for how long will not be clear until the transaction is complete. Some lawyers will ask for payment of some interest up front, and will reimburse you if it is not used. Some will wait until after the transaction is complete, and bill you for excess money used to close the transaction.

Leave a Reply

Want to join the discussion?Feel free to contribute!