Quick Primer on Reading Reserve Funds Studies – Deficits! Deficits! Deficits!

It shocks me how regularly I find underfunded reserve funds in condominiums.

I don’t mean that from a perspective that based on the depreciated value of the asset, in accordance with the assessment of experts, that condominiums do not have 100% of that depreciated amount in the bank. Because that rarely would be the case. I can’t remember EVER seeing that. I mean it from the perspective that a reserve fund study says that the condominium should be funding $80,000 a year, and the condominium is collecting less. Way less. Even 50% less, on an annual basis.

There is a lot of reasons why you may be collecting less than is stated in the report. However, most boards do not clarify those details in their documents. More often than not though, they should be collecting more. If nothing more than the interest income calculations are usually way off.

The worst part is that many condominium boards assert that “they are funding the reserve fund in accordance with the reserve fund study” in their estoppel documents, and they are CLEARLY not. However, I don’t suspect they are doing it for nefarious means. While most volunteer boards likely don’t want to force themselves and their neighbours to pay increased condominium fees — most individual board members would prefer that to a huge special assessment coming due on their property. So, I am left with the belief that it is a failure to understand the documents that boards are reviewing in determining the fees to be set.

The biggest hurdle is that these documents are massive, overly complicated, and not intended for the average condo owner to understand. Therefore, a quick primer in how to decipher them.

Step 1: Go to the financial projections in the back of the document.

Look for a few specific numbers, which I am trying to simplify in this primer:

- Current Reserve Requirements means “how much money do we need right now, based on estimates of experts, to replace or repair property up to 100% based on current prices?”. There is also usually a number that shows that same amount based on inflated prices when the repair comes due.

- Annual Reserve Fund Income means “This is how much money you should be collecting on an annual basis.” It may be broken up between a few amounts, like:

a) Regular Annual Contribution– This is base amount you should be collecting for ongoing improvements. Based on depreciation and age of capital elements of building. This amount may increase over time in the study, either with annual increases, or a jump after a certain number of years.

b) Interest Income – You should have extra cash in the bank. You should be earning interest income on that money. The reserve fund will estimate (often high, right now) what the return on the money should be, usually in the form of interest. This is not a “gravy” extra amount. It is fundamental to the funding projections.

c) Catch up amount – This is an amount you should be collecting to catch up for under funding problems in the past. Failing to collect it now is just going to aggravate the problems.

- Annual Cash Reserves – The amount of cash expected to be in the reserve fund at the beginning or end of the year it describes (timing will depend on the report).

- Annual Expenditures – The amount of cash that the report writer expects that you will be paying for capital improvements to do repairs in any given year.

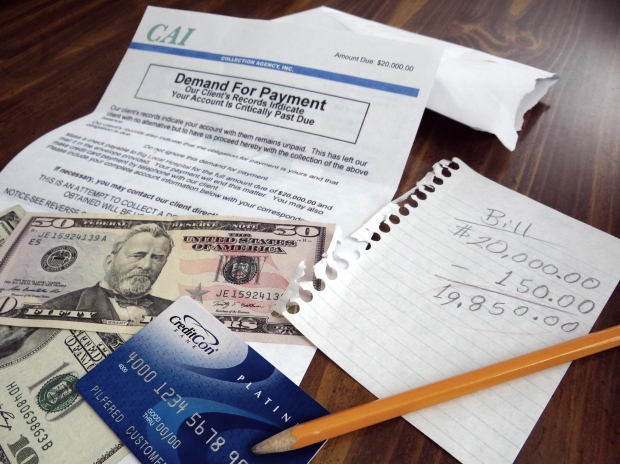

Now try to understand what the numbers are telling you. If your Current Reserve Requirements are $1 million, and you have $200,000 in the bank, it means, with oversimplification, that you are missing $800,000 from your reserve fund. If you have 50 units in the building with equal unit factors, that means you have an unfunded liability of about $16,000 a unit.

It doesn’t mean that you will need $16,000 tomorrow. It means that if you aren’t collecting more than you need for current improvements, that you will be in a deficit cash position eventually.

So look at your Reserve Fund Income in your report. Does it match your condominium’s financial statements? Are you adding the base and catch up amount that you should be? Are you getting the interest income that you should be? If not, it isn’t a surprise that you are showing signs of being underfunded.

How urgent is it to change the behaviour? Look at the projected Annual Expenditures. If it looks like you are going to be burning through cash in the next few years, you need to change immediately. It may already be too late to do it through a simple fee increase. A special assessment may become necessary.

Step 2: Try to find out if there has been any major improvements that do not line up with the improvement schedule.

The biggest reason that you may have less cash than is projected in your reserve fund is that a major improvement came earlier than was projected. The roof may have been projected to go in 2016, but for one reason or another, needed to be replaced in 2012. That would mean that in 2014 we may have $200,000 less in Annual Cash Reserves, but that could be healthy, as we expected to pay $300,000 in 2016 on a roof.

The difficulty is that there is no easy way to determine if this has occurred or not. Potential owners can look through old board and AGM minutes or financials to see what repairs have been done, but it may lack the detail necessary.

Condo Boards, if you want to add value, keep an outline of how capital improvements have differed from that schedule. Be able to answer questions about the expenditures out of a reserve fund, and its ability to meet the future demands of the condominium community.

Step 3: Update your Reserve Funds Regularly.

New legislation now requires a reserve fund to be completed every 5 years. That’s the minimum. If you feel like there is a good fiscal reason to update the reserve fund more regularly, then do so. The last one I read suggested that the owners replace it every three years. It was eight years old, and the last reserve fund that was completed for this condominium.

Step 4: If Still Confused…

Talk to your lawyer.

I might know a guy. 🙂

Leave a Reply

Want to join the discussion?Feel free to contribute!